|

And Now - - -

Your return's been filed. You can rest easy until next year.

Don't relax yet. IRS never rests. Be prepared for what may happen before next year.

On Extension? October 15 is the deadline for your return. Any payment was due April 15. IRS adds carrying charges for late payments. Please gather the missing paperwork quickly - a last-minute surprise can be expensive! If you qualify for a rebate check (see next article) you must file a return, else IRS cannot calculate your rebate amount.

Refund Late? IRS won't help until 8-10 weeks after you file. Try: 1-800-829-4477 - automated help 1-800-829-1954 - refund hotline The IRS website www.irs.govhas a "Where's My Refund?" link.

Still Owe? IRS sends bills in June. They show the balance, plus any interest and/or penalty. The bills only allow a 10-day "grace period" before the amount changes again.

Pay Soon. Send what you can. Write your Social Security Number on the check and "Income Tax - Year 2001". If you can pay off the bill within a couple of months, do it.

Installment Plans. IRS has installment plans, but charge up to $105 to set one up. If you can pay the balance with the second billing from IRS, don't waste the money by asking for a plan.

Pay by Credit Card. You can pay this way, but "convenience tees" as high as 2.5% apply. Call: 1-8002PA Y-TAX, or 1-888-PA Y-I040. More details at www.irs.gov.

Find an Error? If you spot an error on your return, we can file an amendment. Both you and IRS have 3 years after the filing deadline to change your return. If you owe IRS, you pay the tax plus interest. Ifthey owe you, it works the same. You collect the savings plus interest.

Uh-Oh - an IRS Letter! If you get a letter from IRS, call me. The letter may be confusing. Don't risk making an even bigger mess I'll be glad to handle it.

Will You Be Audited? There's no sure way to know. Most "audits" are done by a computer. It compares your return with W -2 forms and 1099 reports from banks and brokers. Ifthere is a discrepancy, you get a letter showing how much you owe if IRS is right - it looks like a bill. Don't pay! Send it to me, and we'll see what's what.

About 15% of "audits" involve a face-to-face meeting with an IRS employee. Call me right away if you get a letter requesting a meeting!

Keep Your Records. For now, put your return and all records in a sate place . You might need to dig them out for an audit some day.

Older Records. It's a good idea to keep tax returns indefinitely. Also, keep records of investments and properties you still own. Other records - cancelled checks, receipts, bank statements, etc. - keep five years' worth of these for safety. Destroy or shred any older records. Don't toss them in the trash!

Your Tax Rebate

You probably already received a rebate check from IRS. The rebate is NOT taxable. Please remember, the rebate is a - - -

2008 Tax Return Item. Congress wanted this money to reach folks as soon as possible. They told IRS to issue rebates based on 2007 returns. We will need to "close the circle" on your '08 return. We'll report the rebate you received. Ifthe '08 return shows you qualify for more, you get it! If the return says you should get less, you may keep the money you already got.

Rebate Basics. Note the word itself - "rebate". It's a return of your income tax. Each filer is allowed up to $600 of reduction (or rebate) of tax. This is true. as long as the filer is not claimed as the dependent of another. Add an extra $300 for each dependent child not yet age 17.

"Minimum" Rebate. If your tax bill is below $300, you get a $300 minimum rebate as long as you have the right kind of income - $3,000 or more from work or job, and/or a government pension, including Social Security.

Non-Filer Opportunity. Many older folks do not need to file a tax return. But, rebates are based on '07 tax returns. With $3,000 or more of the right income, they should file. IRS has a simplified filing method. If you know such a person, call me.

Lots More Rules. Yes, there's a "phase out" for wealthier filers, plus a whole bundle of complex rules. The bottom line - if you file a 2007 tax return IRS does the calculation. However, we can claim any shortfall when we file your 2008 tax return.

Little Loopholes. IRS won't take back any of the rebate based on your '07 return. But, if your '08 return qualifies for more, you will get it. This opens a few opportunities:

- Separated parents of a child under 17 win if one parent claims the child in '08, but the other parent claims in ' 09.

- Folks with too much income in '07 could perhaps defer income in '08 and earn the rebate.

- Couples with high income who lost the rebate in '07 might win in '08 by filing separate returns.

In Store for 2008

Some 2008 changes might have a big impact on your tax bill.

Kiddie Tax Until Age 24. If J5Y your child's investment income is over $1,800, we compute the tax on the extra income at your rate and at the child's. The youngster pays the higher bill. In '07 this applied to dependents under age 18. For 2008, the age jumps to 19, and to 23 if the child is going to school.

We must complete both returns at the same time. Do not let the youngsters file until you are ready to file.

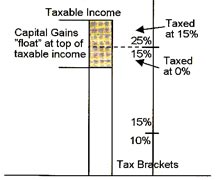

0% Capital Gain Rate. This will only apply if you have moderate income. First, we calculate taxable income with no capital gain. If your tax bracket is already 25% or higher, capital gains are taxed at 15%. If you are below the 25% bracket, any capital gain falling below 25% is not taxed. Additional gain is taxed at 15%. This applies to gains on assets you held more than one year.

Pictorially, it looks like this:

If you are normally below the 25% bracket, you benefit from this change only on capital gain amounts that push you to the start of the 25% bracket. Additional gain is taxed at 15%. The 25% bracket starts at $32,550 for single filers, $65,100 for couples.

Forgiven Mortgage Debts. Late in 2007 Congress offered limited help for those who lost a home through foreclosure. Normally this only happens if the property's value has declined. Suppose you owe $250,000, but such homes sell for only $210,000. If you are foreclosed or abandon the home, the bank will sell it for $210,000. lithe bank forgives the $40,000, you might have income due to relief of debt. I say "might" since this is a very complex area of law. The complete answer depends on the type of loan and the state where the property is located.

If there really is income, the new law may let you exclude it. You may only exclude canceled "acquisition debt". This is debt to buy, build, or improve the home. If that $250,000 you owed was the original mortgage, you're OK -the canceled debt can be excluded. But, if the original loan was only $225,000 and you did a refinance to $250,000, we need to ask what the extra $25,000 was used for. If none was used to improve the property, the first $25,000 canceled by the bank is still income, and only $15,0000fthe $40,000 forgiven is excluded. The new law applies only to your principal residence, and is set to run for 2007, 2008, and 2009.

Smaller Changes. Many tax laws are indexed for inflation. You may put more into an IRA for 2008. The new amount is $5,000, or $6,000 if you are 50 or older. Mileage rates for business driving are now 50.5¢ per mile. There are more, but this will do for now.

Call Me For Help with new items - family changes, large change of income, a move, job change, or new investments. I may be able to find some help for you. Next February will be too late!

Would you like to read a past issue. Please check out one of these issues:

Spring 2008

Winter 2008

Summer 2007

Spring 2007

Winter 2007

Fall 2006

Winter 2006

Fall 2005

Summer 2005

Spring 2005

Winter 2004

Summer 2004

Spring 2004

|