|

2008 Tax Changes

Loads of changes. The economy looks weak. Congress enacted lots of changes to encourage people and small businesses to spend. A rash of disasters prompted more changes.

Stimulus Rebates.

You must report the rebate check you got, so dig out the amount. It's not taxable, but you may qualify for more based on your 2008 return. If you didn't file for 2007, or lost the rebate due to high income (or wrong kind of income), you'll have a "second chance" on the 2008 return.

Charity From Your IRA.

A part of the bailout program, Congress extended an old provision for 2008 and 2009. Folks over 701/2 can make donations to charity from an IRA. The donation reduces your IRA distribution, and you don't claim a tax deduction, your income drops, and you still use the standard deduction - a tax win. If you had planned to make the contribution anyway, it's a win-win deal. You must ask your trustee to send the check directly to the charity to use this tax break.

Non-Itemizer Breaks.

Most tax deductions only help if you have enough deductions to beat the standard deduction. Once you pass the standard deduction, your extra deductions are "gravy" and reduce your tax bill. Here are some changes that can help even if you use the standard deduction.

- Real Estate Taxes. For 2008 and 2009 you may deduct the first $500 of real estate taxes you pay. A couple may claim the first $1,000 spent. Any real estate tax qualifies, not just tax you pay on your home.

- Disaster Losses. We had tornadoes and hurricanes this year, If you suffered a loss in a Presidentially Declared disaster area, you have liberal rules for 2008 and 2009. Such a loss is normally limited. It is deducted only to the extent it exceeds 10% of your gross income. For these two years, this 10% "floor" is waived. In addition, the loss may be added to your standard deduction.

- Tuition Deductions were revived through 2009. Families may deduct the first $4,000 spent on college tuition and fees. This drops to $2,000 if income hits $65,000 ($130,000 for couples), and disappears if income reaches $8O,OOO ($160,000 for couples).

Sales Tax Deduction.

Another rule extended for 2008 and 2009. If you normally itemize deductions, you may deduct the larger of your state income tax payments or your sales taxes. In states with no income tax this is a big win. Even in states with income tax, the sales tax deduction might be larger. Tables give a figure based on your income. However, you can add any sales tax paid on a purchase of a new vehicle, boat, or airplane.

Other Changes.

Check the items below to know whether you are affected by any new rules.

- Mileage Deductions were increased mid-year. Through June it's 50.5¢ per mile. July through December - 58.5¢.

- Energy Credits. Extension for some residential credits. The credit is 10% of cost, with a limit. Gas or oil water heater or furnace - $150. Energy efficient improvements/cooling systems - $300. Advanced main circulating fans - $50.

- Teacher Expenses may be claimed on the first $250 spent on classroom materials. Revived for 2008 and 2009.

- Alternative Minimum Tax relief for 2008 in the form of increased exemption amounts.

- Mortgage Insurance Premiums remain deductible if income is below $110,000.

- Credits for research and two different jobs credits.

- Businesses are encouraged to buy new equipment with big increases in depreciation for the year 2008 only.

Tax Traps

Watch Out For These!

Here are some tax issues that can be a nasty surprise. If one of these affects you, please call me early, so that we can decide how to handle the issue.

Kiddie Tax.

For 2008, your son or daughter under age 24 may need to pay tax at your tax rates. Youngsters with investment income over $1,800 are affected. Some exceptions apply, but please be safe rather than sorry. Warn the youngster not to file a tax return until you and I check this out.

Foreclosures.

If you lost a property during 2008, we have a tough job on our hands. This is true even if you used a “short sale” or simply signed the property back to the lender. I'll need detailed information on how the property was lost, the balance of all loans, as well as your borrowing history for the property. You could very well be taxed on the amount of any part of the loans forgiven by the lender. Please call me right away.

Capital Gains/Losses.

I certainly hope you had only gains during 2008. But, the huge declines in the stock market in September and October say this is not likely. To calculate tax when there are capital transactions, we must aggregate all transactions to find your overall gain or loss.

Overall Gains.

Assuming your gains are long-term, you've probably heard of the “zero-percent” rate on gains for 2008. This is deceptive. Your capital gains are deemed to be the uppermost dollars of your taxable income. You will only see this low rate on dollars not already in the 25% or higher tax brackets. Otherwise the rate will be 15%.

Overall Loss.

Your loss for any year is limited to $3,000. If your overall loss is greater, the excess will carry to future tax years. If your losses are large, this will hurt, but there's no way to change it. A “loss” in your pension plan is a decline in value and is not deductible - it has not yet been “realized”.

Other small changes will make this a very challenging year. During my busy “season” I need to make efficient use of my time. Please let me know as soon as possible if we will need to deal with any of the more difficult issues.

Shift in Home Sales Rules

Since 1997 we have had very liberal rules for calculating tax when you sell your main home. The first $250,000 of gain is completely ignored (excluded), as long as you pass three tests. You must have

- Owned the property at least 2 years in the prior 5 years.

- Used it as your main home for 2 of the past 5 years, and

- Not used the exclusion in the past 2 years.

Unintended Loophole.

Under the law, you might own a home used as a rental. If you move into the property for 2 full years before selling, you are entitled to the full exclusion. A few Americans have already done this!

More reasonable.

The law meant to favor homeowners, not landlords. Suppose a home was owned for 10 years, but used as your main home for only 2 years. It's reasonable to say 2/10 of the gain is a homeowner's gain - the exclusion may be used. The other 8/10 of the gain arises from a rental and should be taxed.

New Law.

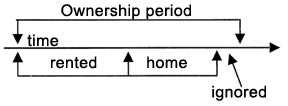

Beginning in 2009, we will eventually arrive at this position. To ensure homeowners are not penalized, the law begins to "track" usage of properties after 2008. On a timeline, it looks like:

The time rented gives no exclusion. The time used as home, does. The time after leaving, but before selling, is ignored - this allows for the fact you might be deciding whether a job change is permanent, or whether you are comfortable in your new location.

Start in 2009.

Any usage prior to 2009 is ignored! You will not be suddenly "hammered" by this law. Beginning next year, however, you must track your periods of usage. Eventually the law will cause an allocation of your gain between the part you may exclude as homeowner, and the part taxable because of your usage as a rental. Here's an example to help you see how this will work:

Example:

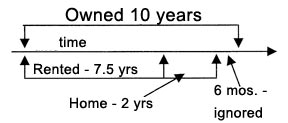

Let's imagine a property you buy on July 1. You hold it 10 years, then sell on June 30 at a profit of $200,000. For part of the time, the property was a rental. This means "gain from appreciation" is $200,000. If you took depreciation of $30,000 during the time of rental, you have an additional "gain from depreciation" of $30,000 and may never exclude this.

Now suppose you move into the property for 2 years, and then you take 6 months to sell the property. It might look like this:

We'll look at different dates:

Bought 7/1/2000.

Your sale is on June 30, 2010. You lived in the home during all of 2008 and 2009. You have tracked no time after 2009 that counts against you. The entire $200,000 appreciation gain may be excluded. The $30,000 gain from depreciation is taxed.

Bought 7/11/2002.

Your sale is on June 30, 2012. You lived in the

home during all of 2010 and 2011. For the year 2009 it was a rental, which counts against you. That's one-tenth of your 10-year ownership. 1/10 of your gain is taxed (plus the $30,000 from depreciation). The other 9/10 of the gain is excluded.

Bought 7/1/2004.

Your sale is on June 30, 2014. You lived in the

home during all of 2012 and 2013. For the years 2009, 2010, and 2011 it was a rental, which counts against you. That's 3/10 of your 10-year ownership. 3/10 of your gain is taxed (plus the $30,000 from depreciation). The other 7/10 of the gain may be excluded.

And So On.

Eventually 75% of the gain will be taxable, since 7.5 of the 10 years are for rental. For the next few years, the impact will be small. If you have such a property, we can discuss your own options and the likely tax impact. Call me.

Would you like to read a past issue. Please check out one of these issues:

Fall 2008

Summer 2008

Spring 2008

Winter 2008

Summer 2007

Spring 2007

Winter 2007

Fall 2006

Winter 2006

Fall 2005

Summer 2005

Spring 2005

Winter 2004

Summer 2004

Spring 2004

|