|

What Will Social Security Recipients' Medicare Premiums Be in 2019?

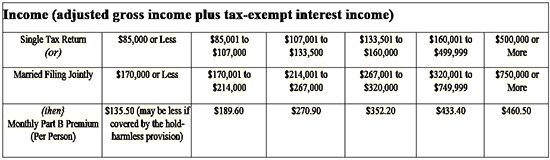

The Centers for Medicare & Medicaid Services announced that most people will pay $135.50 per month for Medicare Part B in 2019, up slightly from $134 per month in 2018.

A small group of Medicare beneficiaries (about 3.5) will pay less because the cost-of-living increase in their Social Security benefits is

not large enough to cover the full premium increase. The "hold-harmless provision" prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits if their premiums are automatically deducted from their Social Security payments. Social Security benefits are increasing by 2.8 in 2019, which will cover the increase in premiums for most people.

Premiums are increased for higher- income beneficiaries - those with adjusted gross income plus tax-exempt interest income of more than $85,000 if single or $170,000 if married filing jointly. These beneficiaries already pay a high-income surcharge, but a new surcharge tier will kick in for 2019 for people with the highest incomes. Overall monthly premiums for higher- income beneficiaries will range from $189.60 to $460.50 per person, depending on income. What you will pay for Medicare in 2019:

Got Everything We Need?

Here is a list of frequently missed items. Check these against your list.

- Child Care Expenses. I need the full name, address, telephone number, tax ID number of your care providers and the total paid per child.

- Estimated Federal Tax Payments. . Find the date and amount for payments. April 15, 2018, June 15,2018, September 15, 2018 and January 15, 2019. A Federal January 2018 payment would have been claimed on your 2017 return.

- Sales of Property. The most important thing is the Final Settlement Statement. Include a list of home improvements in all prior years since purchase.

- College Tuition. Form 1098- T lists tuition paid. These forms are mailed to the student. Make sure that the "student" watches for these forms and gives them to you. I need these forms as well as details on the courses, all education-related expenses, when each item was paid and who the "student" was.

- Sales of Stock. Form 1099- B shows sale price. If this form does not show the original purchase information you will.need.to provide this.

- New Tax Rules On Pass- Through Entities. Schedule K-l from partnerships and S-Corps always seem to arrive late. Don't worry. We can do the rest of your return and be ready to finish when the elusive K-l arrives.

- Social Security Benefits. Look for Form 1099-SSA. We must report the gross amount and not just your net monthly benefit. Your Medicare Premiums listed on the Form may also get you a medical deduction.

- Employees - Last Pay Stub. Your W - 2 is critical, but your last pay stub may reveal tax deductions that don't usually show up anywhere else.

- Special Accounts. Do you contribute to an IRA, Roth_IRA or Health Savings Account? These and others can affect your taxes. Make sure I have all 1099s and information on contribution amounts and dates.

- Complex Transactions. Please call if you have a foreclosure, sale or exchange of real estate, casualties such as theft or natural disaster.

Myth vs. Truth

Myth:

I will pay less taxes for 2018 ... guaranteed!

Truth:

Many people will most likely pay less taxes, but not everyone.

Yes, rates for almost all the individual tax brackets have been lowered and the Alternative Minimum Tax (AMT) exemption has increased, but unfortunately, that doesn't mean that everyone will pay less taxes. The deductions that caused a high-income taxpayer to pay AMT are now eliminated, so some people will pay more in regular taxes for-20J.8-than in 2017, while paying little or no AMT. Personal exemptions have also been eliminated in exchange for a larger child tax credit which disappears when a dependent reaches age 17.

Taxpayers who itemize will be limited to a maximum deduction of $10,000 on their combined state and local income taxes, property taxes and personal property taxes. These are examples of how our complex tax system may end up taking more money from you than in prior years.

Myth:

State Tax Returns won't be affected.

Truth:

Many states that have an income tax often use federal income tax numbers to some extent.

Many people believe that the tax reform won't have any influence over their state's income tax code, but that's not true. The truth is that several states copy federal tax system characteristics and use it as their own or use the federal return numbers as a jumping off point.

Other states do not conform to federal tax characteristics.

Myth:

Tax reform will be bad for seniors.

Truth:

Retirees may be the most concerned about what tax reform will mean for them.

Proposed reforms will not change the way Social Security and investment income are taxed currently.

Many retirees may benefit from the doubling of the standard deduction to $24,000 for married couples filing jointly and $12,000 for single filers.

Myth:

The IRS will call you if they detect an error on your tax return.

Truth:

The IRS initiates most contacts through regular mail delivered by the United States Postal Service.

However, there are special circumstances in which the IRS will call or come to a home-or- business, such as when a taxpayer has an overdue tax bill, to secure a delinquent tax return or a delinquent employment tax payment, or to tour a business as part of an audit or during criminal investigations.

Even then, taxpayers will generally first receive several letters (called "notices") from the IRS in the mail.

Would you like to read a past issue. Please check out one of these issues:

Year End 2018

Year End 2017

Year End 2016

Year End 2015

Year End 2014

Year End 2013

Winter 2013

Spring 2012

Spring 2011

Fall 2010

Summer 2010

Spring 2010

Fall 2009

Summer 2009

Spring 2009

Fall 2008

Summer 2008

Spring 2008

Winter 2008

Summer 2007

Spring 2007

Winter 2007

Fall 2006

Winter 2006

Fall 2005

Summer 2005

Spring 2005

Winter 2004

Summer 2004

Spring 2004

|